Meet the most Robust Performance and Attribution Software on the planet

robust

: strongly constructed

: capable of performing without failure under a wide range of conditions

Source: Merriam-Webster

Robust Technologies

Offers best-in-class software for performance measurement, performance attribution, benchmark customization, risk analytics and GIPS® Composites.

Renowned for its calculation methodologies, our software produces meaningful and accurate results no matter how complex your investment management strategies may be.

Satisfies the most sophisticated investment management firms in the world

Software that makes the job of your performance department

Richer

Better

Easier

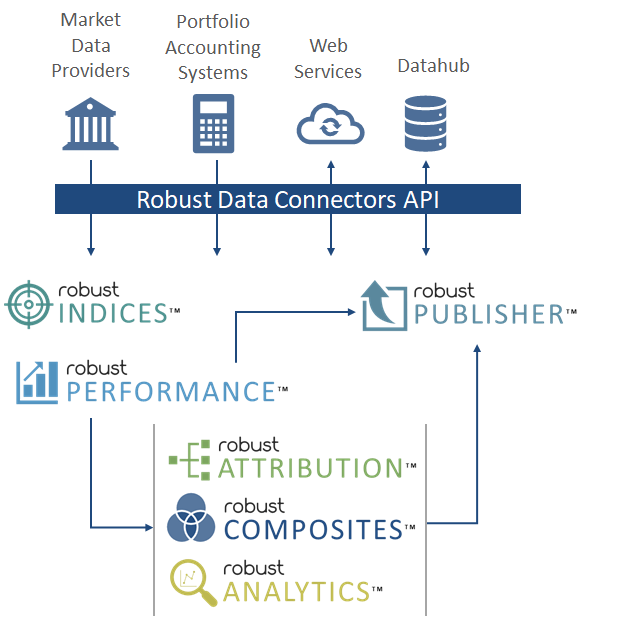

Take control of the whole process. Integrate data from any source such as index providers and portfolio accounting systems. Validate, calculate and generate reports faster, automatically in a streamlined manner. Spend the time you save on value-added analysis activities.

Be confident results are accurate. No mistake is allowed. Results must be bang-on before reports are sent to clients. Automatically identify potential sources of error in inbound data.

Evaluate risk taken to achieve investment objectives.

Demonstrate you add value to your clients’ investment management mandates. Configure attribution models that precisely reflect your investment management decision process.

Better communicate results through sophisticated and complete analyses designed to enable clear and proactive communication on how you realize returns and add value.

Prove your numbers. Answer any question about your investment returns. Immediately, thoroughly, in real time, with precision, detail, clarity. Answer the questions your clients didn’t even know they had.

Demonstrate your investment management skills to prospective clients through decisive performance attribution analysis. Build confidence and long-term relationships.

Rich

Powerful

Comprehensive

State-of-the-art software platform

covers all performance

calculation and reporting requirements

Robust Indices empowers you to create benchmarks that truly represent your management mandates, restrictions and objectives.

Robust Performance gives you the most accurate and comprehensive multi-currency performance analysis there is. Leave no question unanswered.

Demonstrate how your investment decisions add value to your portfolios. Design attribution models that perfectly reflect your decision processes and investment mandates.

Performance history is your firm’s most important asset. And you want to present it to prospects according to the 2020 Global Investment Performance Standards. Robust Composites helps you become and stay GIPS-compliant.

Use Robust Analytics to evaluate the risk taken to achieve your returns. Over 50 risk-adjusted performance measures, from Alpha to Z-Statistic, and everything in between.

Robust Publisher enhances your brand image with visually appealing reports you can tailor as you wish with Microsoft Excel and the Robust API connecting Tableau, PowerBI or your website.

Integrated Streamlined Automated Processing

Use Robust Workflow to streamline your process from end to end.

- Upload data from any source in any format.

- Run single or multi-task jobs for every step of the process, from validating holdings and transactions to producing GIPS reports.

- Automatically handle downstream dependencies and ensure end results line up with the underlying data.

- Validate and highlight potential data anomalies.

Available

Cloud

On Prem

Outsourced

Try Robust today. It’s easy.

We can plug in any one of your portfolios and demonstrate the value Robust adds to your performance analysis.

Get in touch with us for details.

You’ll be proud to be Robust